Home Sale Exemption 2025 - Certificate of exemption form Fill out & sign online DocHub, Taxes when you sell a house. Are capital gains on a residential sale taxed in. Taxpayers who sell their main home for a capital gain may be able to exclude up to $250,000 of that gain from their income.

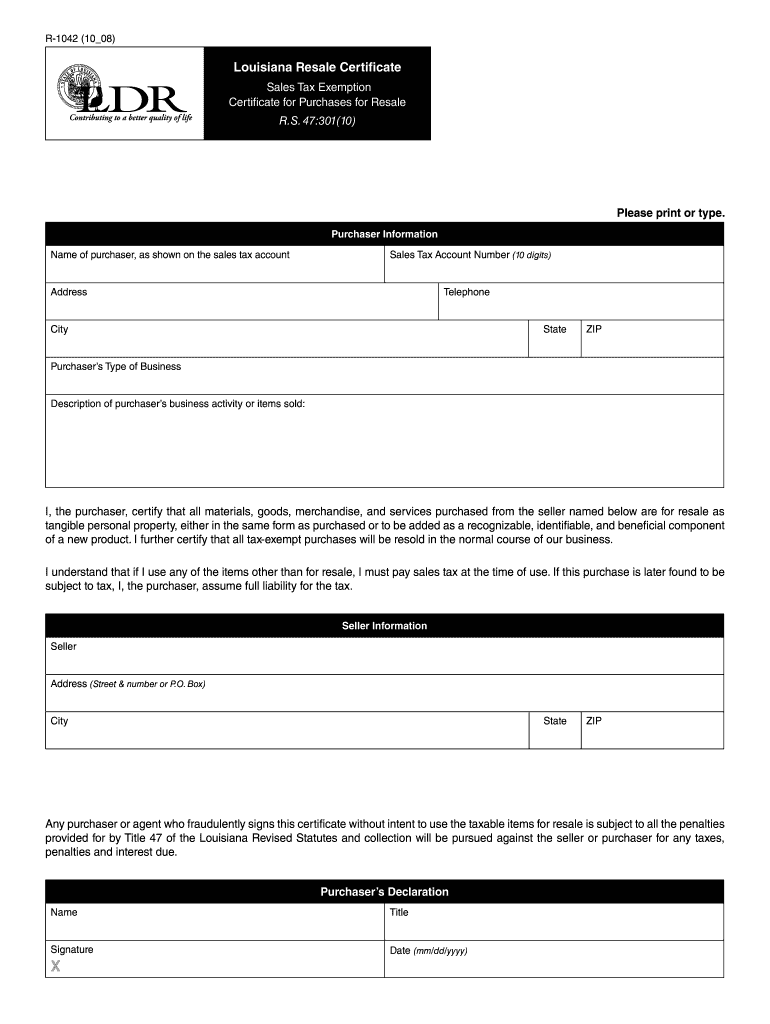

Certificate of exemption form Fill out & sign online DocHub, Taxes when you sell a house. Are capital gains on a residential sale taxed in.

Home Sale Exclusion From Capital Gains Tax, The sale of capital assets may lead to capital gains and these. Your gain from the sale was less than $250,000.

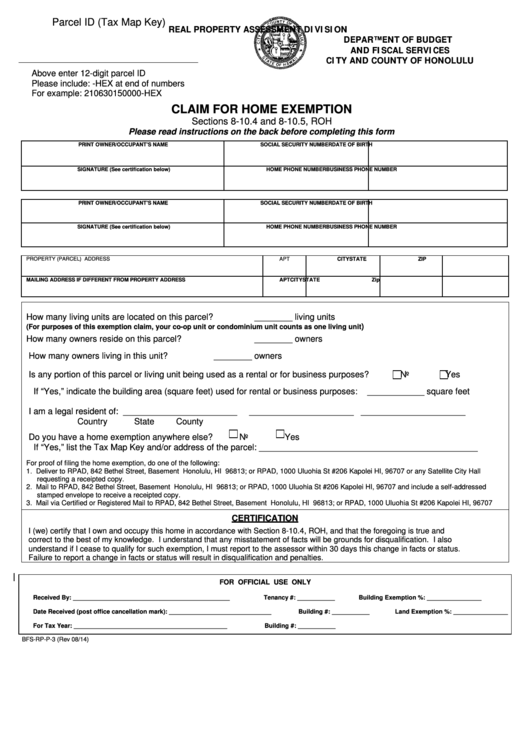

Orange County Homeowners Exemption Form, Taxes when you sell a house. The sale of capital assets may lead to capital gains and these.

Homestead exemption form Fill out & sign online DocHub, This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Taxes when you sell a house.

:max_bytes(150000):strip_icc()/over-55-home-sale-exemption2-46c8496917a1458b8583b6e8b8bc3800.jpg)

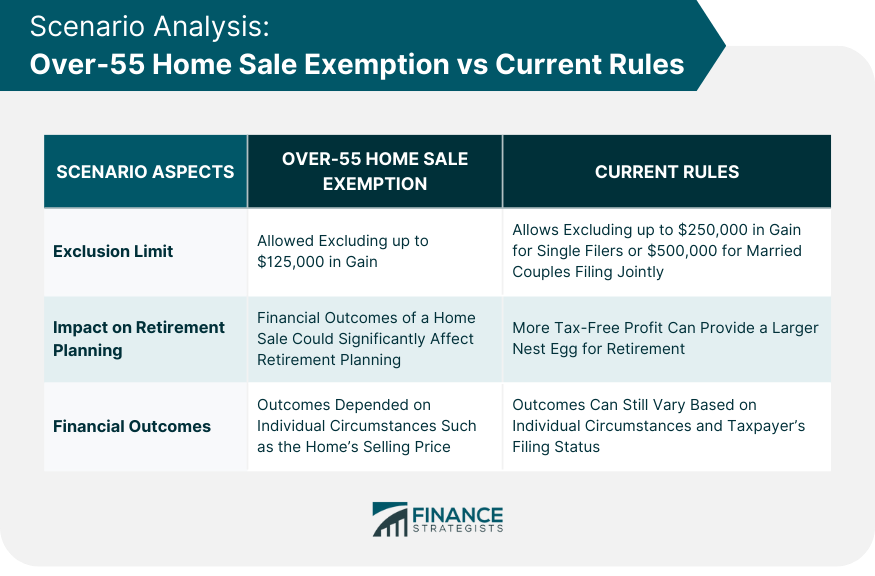

Over55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Giving primacy to the environment over expansion of road networks and other linear projects like laying down pipelines, the supreme court has. How to qualify for the exclusion.

Over55 Home Sale Exemption Definition, Benefits, Applications, Calculating capital gains tax on your home sale. Do you have to pay capital gains tax on a home sale?

A groundbreaking $418 million settlement announced friday by the powerful national association of realtors is.

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Over55 Home Sale Exemption Definition, Benefits, Applications, In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Living away from your home.

Louisiana resale 1064 Fill out & sign online DocHub, You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. How to report your home sale in california for capital gains taxes.

Harris County Homestead Exemption Form, How to qualify for the exclusion. Taxpayers who sell their main home for a capital gain may be able to exclude up to $250,000 of that gain from their income.

Texas Homestead Tax Exemption Cedar Park Texas Living, How to qualify for the exclusion. Current tax law does not allow you to take a capital gains tax break based on age.

Home Sale Exemption 2025. Taxpayers who file a joint return with their. The home sale tax exclusion is one of the most valuable tax benefits available to individuals.

Do you have to pay capital gains tax on a home sale? How to calculate capital gains on sale of house or plot?